Understanding Today’s Mortgage Rates and Where They Might Be Headed

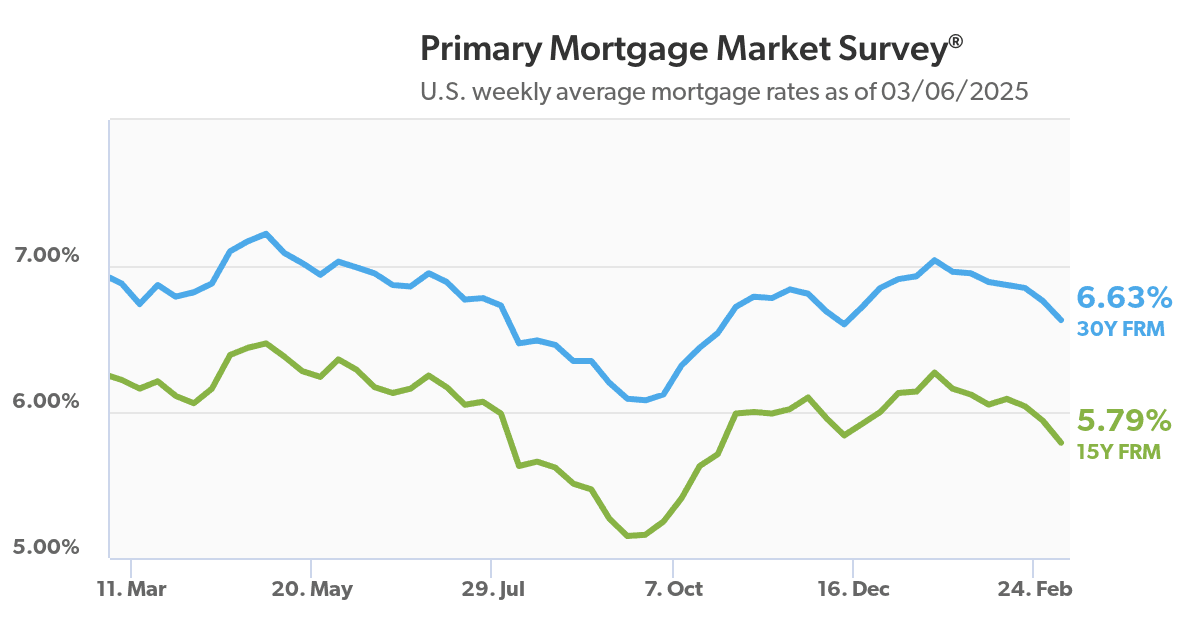

If you're keeping an eye on mortgage rates, you've probably noticed they're still higher than they were a few years ago. But there’s a lot happening in the economy that could cause them to change. Let’s break it down in a simple way so you can understand what’s driving mortgage rates and what might happen next.

Why Are Mortgage Rates Where They Are?

Mortgage rates are influenced by several factors, but one of the biggest is the 10-year Treasury yield—often called the "risk-free rate." Historically, lenders usually charged an average of about 1.75% (or 175 basis points) above this yield to set mortgage rates. Right now, those Treasury yields are high because of concerns over inflation and government spending, which is keeping mortgage rates elevated.

Could Mortgage Rates Go Down?

There’s a chance we might see lower rates in the future. One reason? The Trump administration has announced aggressive efforts to cut government waste and reduce federal spending by $2 trillion. If these plans succeed, Treasury yields could drop, which would likely pull mortgage rates down with them.

But don’t expect a dramatic drop overnight. The Federal Reserve is still keeping a close eye on inflation, and until it consistently hits their 2% target (currently at 3%), they won’t be in a rush to cut interest rates. So, while there’s room for rates to come down, it might take some time.

Why Investors Matter for Mortgage Rates

Another thing to watch is investor behavior. Big investment firms, like PIMCO, are starting to see mortgage-backed securities (MBS) as a better deal than corporate bonds right now. That’s important because when more investors buy MBS, it creates more demand for mortgages, which can help lower interest rates for borrowers. Simply put, when more investors buy into MBS, it helps drive mortgage rates down, making home loans more affordable.

What This Means for You

If you’re thinking about buying a home or refinancing, it’s good to know that rates could go down, but they aren’t likely to drop significantly in the near future. If Treasury yields decrease and investors continue favoring MBS, mortgage rates may follow, but inflation and Federal Reserve decisions will still play a big role in how things unfold.

Bottom line? Stay informed and keep an eye on market trends. If you’re in the market for a home or thinking about refinancing, talking to a lender about timing could help you make the best decision in this ever-changing mortgage landscape.

For personalized real estate advice from a Devonshire expert, call Brendan Hirschmann, REALTOR® at 972-559-4648. Brendan can provide you with the insights and guidance you need to navigate the current market trends and make informed decisions.